Swing Trading the E-Mini NASDAQ Futures Contracts: A Comprehensive Day Trading Guide

Day Trading and Swing Trading in the E-Mini NASDAQ: A Comprehensive Guide

The E-Mini NASDAQ futures market offers traders a plethora of opportunities. With the right strategies, especially focusing on price action trading, traders can navigate the complexities of the market and aim for sustained success. This article delves deep into the intricacies of day trading and swing trading in the E-Mini NASDAQ, providing insights and strategies to enhance your trading journey.

E-Mini NASDAQ Swing Trading Strategy: An Introduction

Swing trading in the E-Mini NASDAQ is a potent method to capture significant price movements over short to medium-term periods. This section introduces the nuances of swing trading in this specific market, highlighting how traders can target substantial profits by understanding and leveraging price action trading.

Naked Price Action Trading in Day Trading Context

Naked trading, especially in the realm of day trading, is about focusing purely on price action without the distractions of numerous indicators. This segment introduces this streamlined approach, emphasizing the importance of support and resistance levels, trend lines, and price patterns in the E-Mini NASDAQ market.

Deep Dive into E-Mini NASDAQ Price Action Trading

Price action is the cornerstone of successful day trading in the E-Mini NASDAQ. This section delves deeper into the intricacies of price action, discussing the significance of subjectivity, understanding market context, and the role of time in markets. It also touches upon the individuality of traders and how it influences their interpretation of price action.

In the fast-paced realm of the E-Mini NASDAQ, understanding price action is not just a strategy; it’s a necessity.

Mechanics of Futures Markets: E-Mini NASDAQ Focus

To succeed in day trading the E-Mini NASDAQ, understanding the mechanics of the futures market is paramount. This segment provides insights into the basic workings of the futures market, the significance of passive aggressive orders, and offers a detailed perspective on market participants in the E-Mini NASDAQ futures.

Advanced E-Mini NASDAQ Price Action Trading Strategies

As traders advance in their journey, they need sophisticated strategies tailored to the E-Mini NASDAQ market. This section explores advanced price action trading techniques, discussing the dynamics of upward price movements, downtrends, and market consensus. It also sheds light on specific strategies like iceberg orders and the nuances between spoofing vs. iceberg orders.

Refining Your E-Mini NASDAQ Day Trading Approach

The final segment emphasizes the importance of continuous refinement in your day trading strategies, especially in the E-Mini NASDAQ market. It discusses techniques to enhance trading outcomes, focusing on avoiding pitfalls like misinterpreting volume and the importance of understanding intricate price action nuances.

Adaptation and evolution in your trading approach are the cornerstones of success in the E-Mini NASDAQ market.

Futures Trading E-Mini NASDAQ Swing Trading Strategies with Our YouTube Course Deep Dive

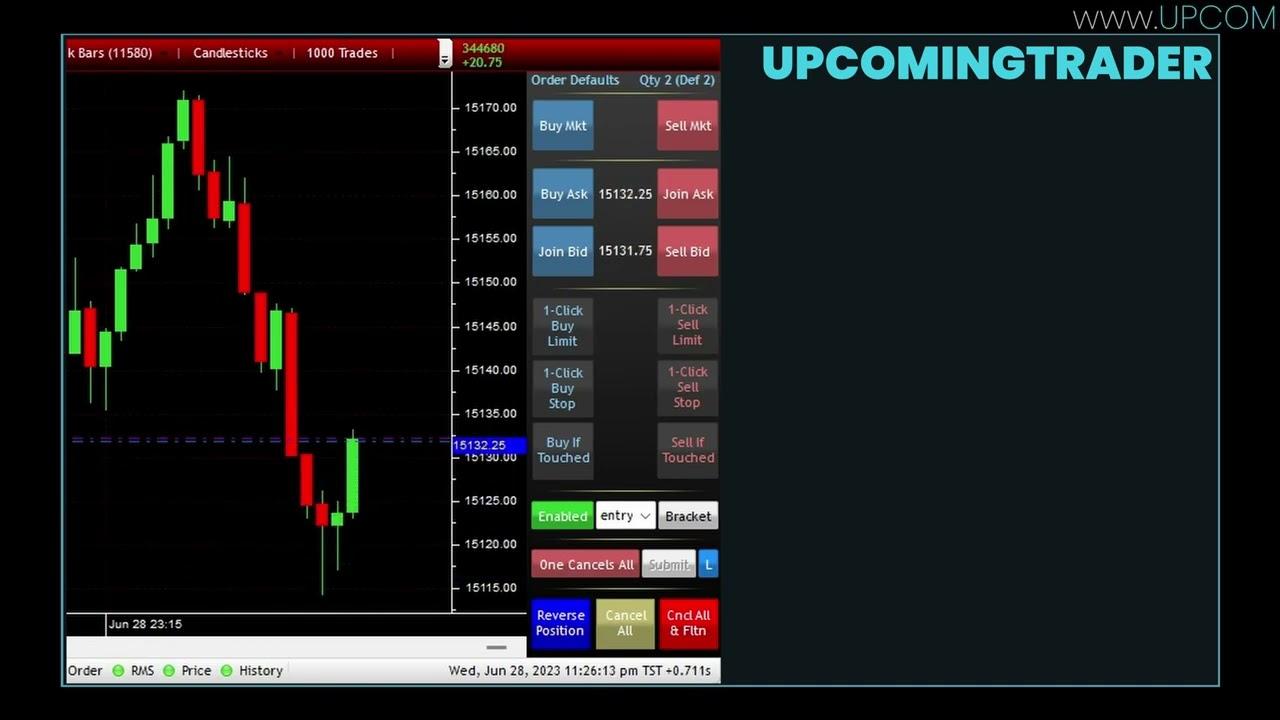

For traders looking to further hone their skills and gain a more in-depth understanding of day trading the E-Mini NASDAQ futures, our YouTube playlist titled: “Swing Trading Course - Day Trading Nasdaq Futures” is a must-watch.

This comprehensive course covers advanced strategies, expert insights, and practical examples to help you navigate the complexities of the market. Whether you’re just starting out or looking to refine your approach, this course offers invaluable lessons to elevate your trading game. Click on the video below to embark on this enlightening journey.

Mastering Day Trading and Swing Trading Strategy in the E-Mini NASDAQ

The world of day trading and swing trading in the E-Mini NASDAQ is both challenging and rewarding. By harnessing the power of price action trading and continuously refining your swing trading strategy, traders can position themselves for consistent success in this dynamic market. Continuous learning and adaptation are the keys to trading mastery.

Excited by What You've Read?

There's more where that came from! Sign up now to receive personalized financial insights tailored to your interests.

Stay ahead of the curve - effortlessly.