Futures Contract Speculation: Navigating Day Trading Amidst Market Volatility

The Significance of Market Liquidity

Liquidity is the lifeblood of any financial market, and futures trading is no exception. A liquid market ensures that traders can enter and exit positions with ease, minimizing slippage and maximizing potential returns.

In the realm of futures trading, understanding market liquidity is paramount to making informed trading decisions.

Day Trading Dynamics: Navigating Liquidity in the Futures Market

The psychological aspect of trading also comes into play. Traders, especially those new to the futures market, may be swayed by emotions, leading them to make impulsive decisions during periods of low liquidity.

This is where risk management strategies become crucial. By setting clear stop-loss orders and understanding the liquidity of specific futures contracts, traders can mitigate potential losses and navigate the futures market more effectively. Embracing both the technical aspects of liquidity and the psychological challenges of day trading is key to thriving in the dynamic world of futures trading.

The 24/7 Trading Window: An Unparalleled Advantage

One of the standout features of futures trading is the 24/7 trading window. This round-the-clock access allows traders to respond to global events and market shifts in real-time, setting futures trading apart from other financial instruments.

Speculation: The Driving Force of Futures

At the heart of futures trading lies speculation. This concept, while often misunderstood, plays a crucial role in driving market movements. By delving into speculation, traders can better anticipate market trends and position themselves for potential gains.

Reaping the Benefits of Speculation

Speculation about leveraging market knowledge for potential rewards.

Speculation isn’t just about taking risks

By understanding the positive aspects of speculation, traders can harness its power to their advantage, capitalizing on market movements and trends.

Treading Carefully: The Downsides of Speculation

However, with great potential comes inherent risk. It’s essential for traders to be aware of the pitfalls and challenges associated with speculative trading. By staying informed and adopting a balanced approach, traders can mitigate potential losses.

Diversification: A Trader’s Best Friend

In the world of finance, diversification is often touted as the go-to strategy for risk management. In futures trading, diversification plays a pivotal role, allowing traders to spread their investments across various assets, thereby reducing potential risks.

Diversifying with E-Mini Futures: S&P 500 and NASDAQ

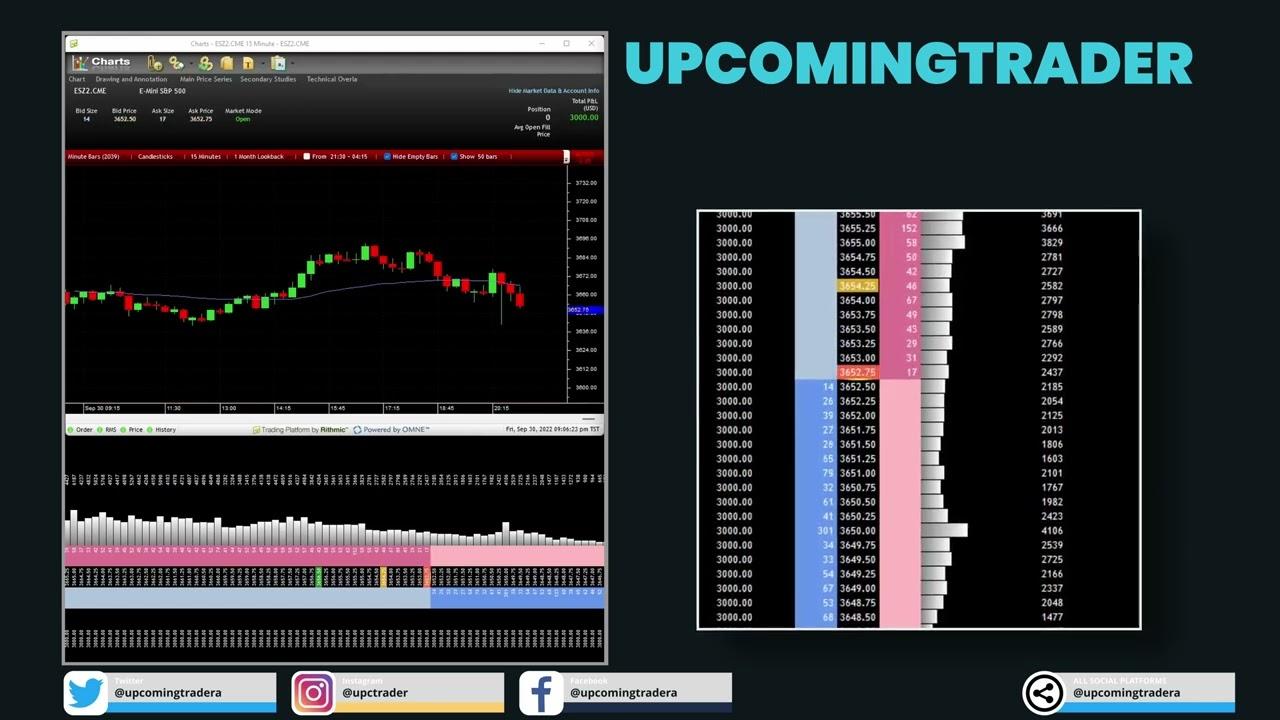

One of the most effective ways traders achieve diversification in futures trading is by trading multiple futures instruments. Among the popular choices are the E-Mini S&P 500 Futures and the E-Mini NASDAQ Futures.

E-Mini S&P 500 Futures represent a fraction of the standard S&P 500 futures contract. They allow traders to speculate on the future price movements of the S&P 500 Index, which comprises 500 of the largest publicly traded companies in the U.S. Given the broad nature of this index, trading E-Mini S&P 500 Futures offers a level of inherent diversification as the index itself is spread across various sectors of the economy.

E-Mini NASDAQ Futures, on the other hand, offer traders exposure to the tech-heavy NASDAQ Composite Index. This futures contract allows traders to speculate on the tech sector and other industries predominant in the NASDAQ, such as biotechnology. By trading E-Mini NASDAQ Futures, traders can diversify their portfolio by tapping into the growth potential and volatility of the tech industry.

The Transparent World of Futures: Price Discovery

Transparency is a hallmark of futures markets.

With clear price discovery mechanisms in place, traders can operate with confidence, knowing that the prices they see reflect the true market sentiment.

Day Trading and the Psychological Landscape of Price Discovery

Engaging in day trading within the futures market requires not only a keen understanding of price movements but also a mastery over one’s own trading psychology. The futures market, with its transparent price discovery, offers traders a clear view of how futures contracts are valued in real-time. This transparency, while beneficial, also brings to light the psychological challenges traders face.

For instance, seeing real-time price fluctuations can evoke strong emotional responses, especially for day traders who often make multiple trades within a short time frame.

The fear of missing out on a profitable trade or the anxiety of a potential loss can sometimes overshadow the objective data presented by the price discovery mechanism.

Leverage in Futures Trading: A Double-Edged Sword

Leverage, while offering the potential for significant returns, comes with its set of risks. It’s essential for traders to understand the implications of leverage in futures trading and to navigate its challenges with caution.

In conclusion, futures trading offers a world of opportunities for those willing to invest the time and effort to understand its nuances. Whether you’re a novice looking to dip your toes or a seasoned trader seeking to refine your strategies, the dynamic world of futures trading awaits. Dive in, equip yourself with knowledge, and embark on a journey of financial discovery. And as always, for more expert insights and strategies, don’t forget to like, share, and subscribe!

Excited by What You've Read?

There's more where that came from! Sign up now to receive personalized financial insights tailored to your interests.

Stay ahead of the curve - effortlessly.